We talk a lot about growth, marketing, SEO & all the fun sides of startups and entrepreneurship, but there's more to online business than that.

Let's take a crash course in financial statements, shall we? We're not accounting experts so we're not going to pretend like we're an authority in this field. That's why you'll find helpful external links all over this article!

The 3 financial statements businesses issue to report their financial performance are:

- Cash Flow Statements

- Balance Sheets

- Income Statements

@freshbooks has a good tutorial on how to read each of these statements.

If you're a sole proprietor of a blog or other online business, you might not ever need to formally make all these statements, but they do help paint a picture about the financial health of your business. As a matter of fact, some business entities, like corporations, are required to generate these statements.

Regardless, it's a good practice to run your website as if it's a real business - because it is! If you ever want to sell your online business, for example, prospective buyers will probably ask for these statements. Might as well get familiar with them!

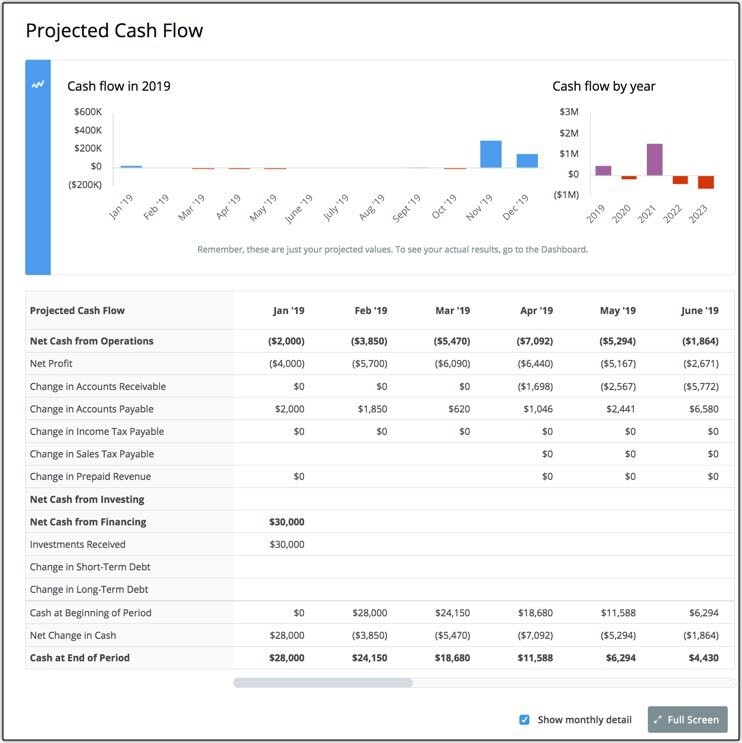

#1 - CASH FLOW STATEMENT

1a) The cash flow statement shows actual cash inflows and outflows of a business over time.

It basically measures how well a company manages its cash. @noahparsons and @Bplans explain cash flow statements in this article:

1b) For a small online business, your cash flow statement doesn't have to be complicated. @scalefactor has a good tutorial on creating your own simple cash flow statement here:

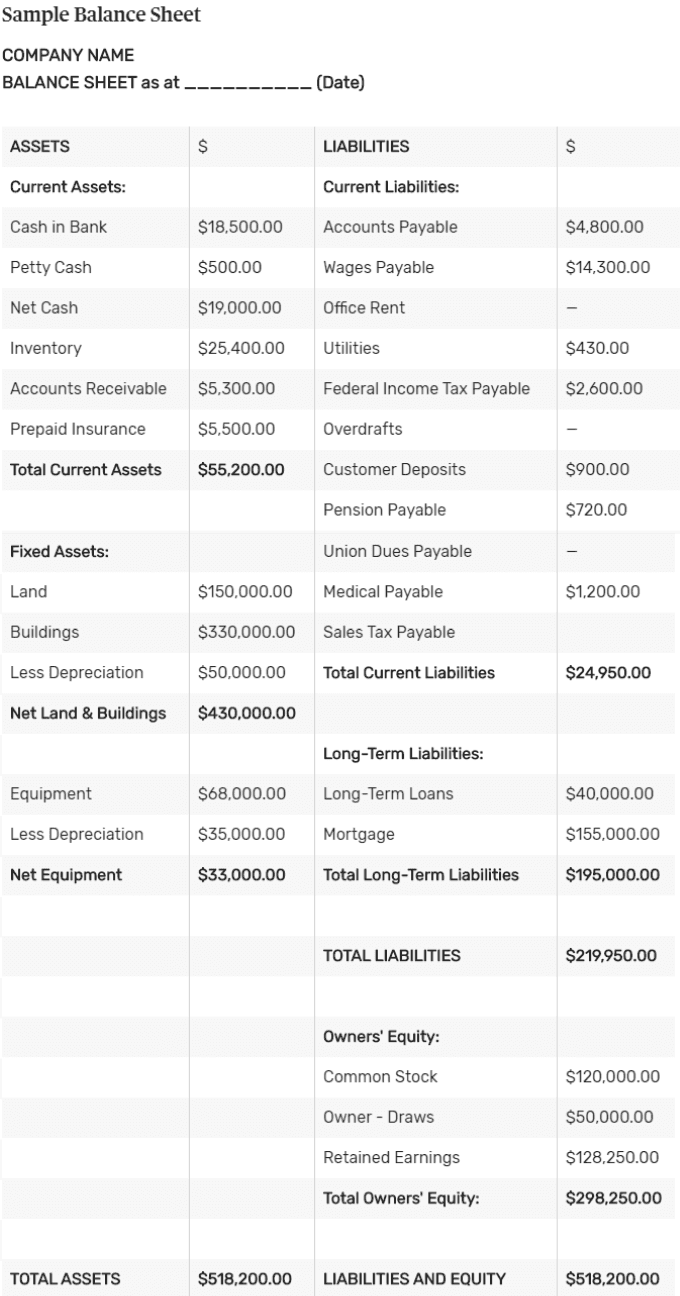

#2 - BALANCE SHEET

2a) "A balance sheet is a statement of the financial position of a business that lists the assets, liabilities, and owner's equity at a particular point in time... The balance sheet illustrates your business's net worth."

-@thebalance

2b) That sample balance sheet looks complicated but most small online businesses, even ecommerce, won't have nearly that many spending categories. Keep it simple. A balance sheet simply summarizes:

- What you own

- What you owe

@Bench walks you through the steps to make one for yourself:

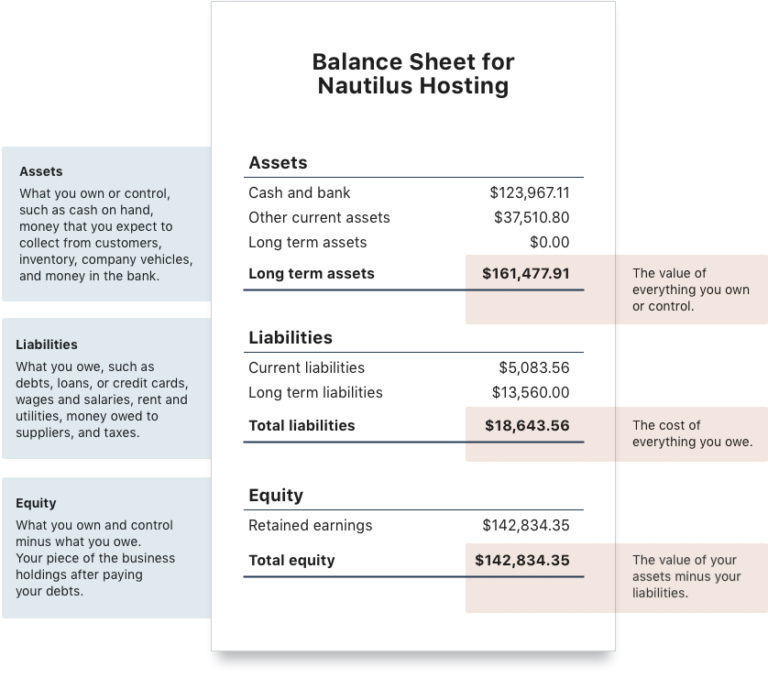

2c) One of the best graphics we've seen for a simple balance sheet is this one from @WaveHQ

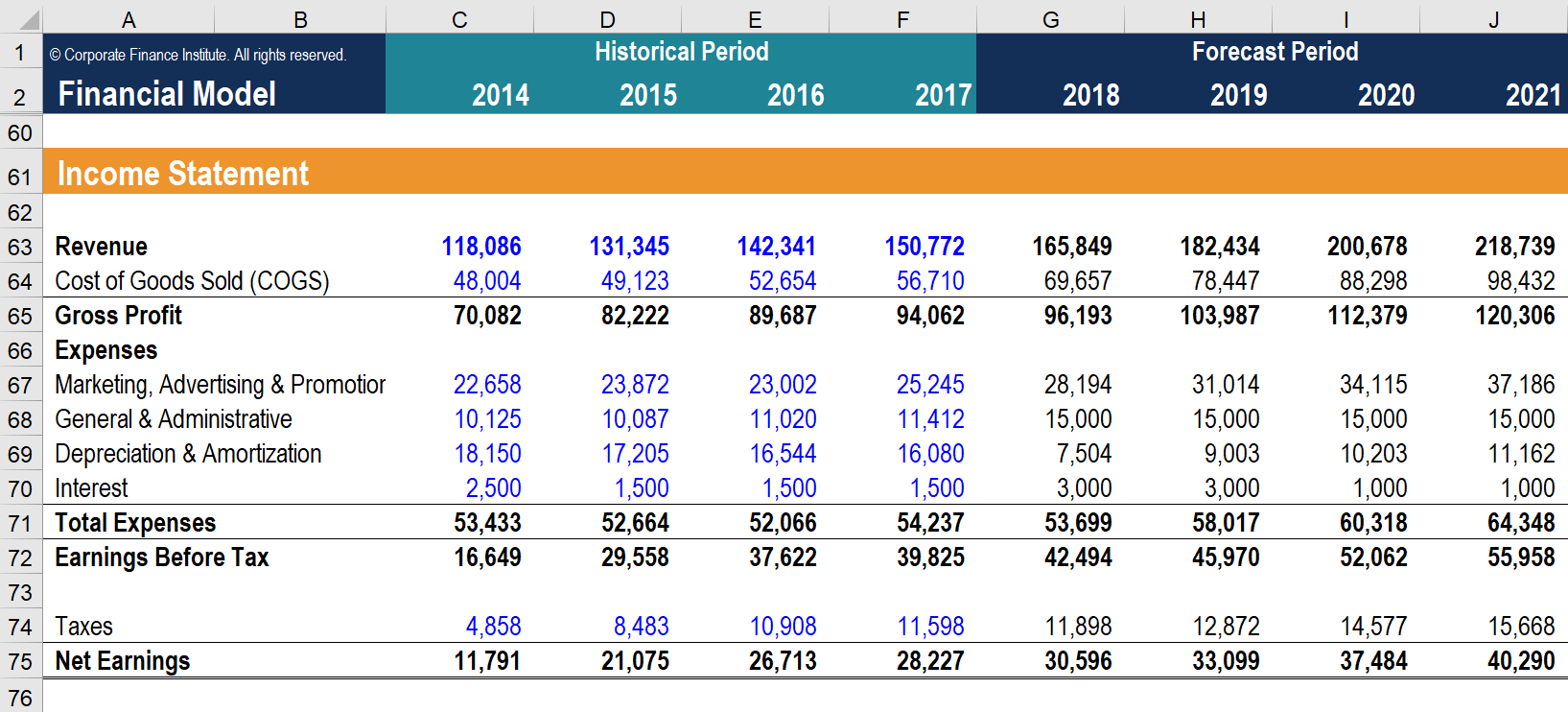

#3 - INCOME STATEMENT

3a) An income statement displays the company's revenue, costs, gross profit, selling and administrative expenses, other expenses and income, and taxes paid. In other words, it shows profits and losses. Here's a @CFI_education guide:

3b) An income statement is used for more than gauging net worth. Use it to find areas of your small business over or under budget and to find where to cut costs. Income statement = profit and loss statement. @1BusinessTown has a tutorial for making one:

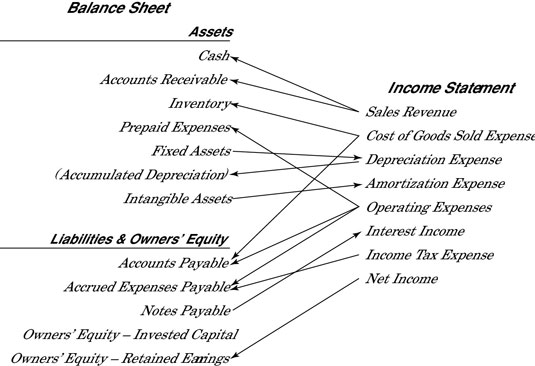

3c) There's a fantastic image and article from @ForDummies that illustrates the relationship between items in an income statement and items in a balance sheet. They're closely related, but they report different financial accounting information about your business.

MAKING FINANCIAL STATEMENTS

4a) Financial statements are created in 3 different ways:

- With software

- By a bookkeeper

- By an accountant

4b) You can make all 3 of these fundamental financial statements yourself with Excel. @Vertex42 has pre-built templates for each statement type:

- https://vertex42.com/ExcelTemplates/cash-flow-statement...

- https://vertex42.com/ExcelTemplates/balance-sheet.html

- https://vertex42.com/ExcelTemplates/income-statement...

4c) Alternately, there are some nice accounting apps and software that track income and expenses and make financial statements for you. @QuickBooks, @Xero and @WaveHQ are common ones.

@PilotHQ compared all 3 of them so take a look and see which is best for you:

4d) If you'd rather focus on making money instead of tracking money, hire a bookkeeper. @Bench is one of the best online bookkeeping services. We haven't used them but they're very highly rated.

4e) You can also hire a bookkeeper on freelance sites, like @Upwork.

Bookkeepers are less expensive than accountants, so it's common to outsource to a bookkeeper throughout the year, then handoff your records to your business accountant at the end of the year.

4f) Finally, accountants verify and analyze your data to generate reports, perform audits & prepare records, like tax returns. If your accountant does your small business bookkeeping, you might be paying too much. @BNDarticles explains the differences between accountants and bookkeepers here:

We paired this entire article into a way-too-long threaded Tweet so if you enjoyed it, please retweet it below. Thank you for reading it!

SHARE OUR TWITTER THREAD:

We talk a lot about growth, marketing, SEO & all the fun sides of #startups and #entrepreneurship, but there's more to online business than that.

— Cohoist (@cohoist) May 26, 2020

Let's take a crash course in financial statements, shall we?

THREAD pic.twitter.com/EROdx810NV